Estimates, Choices And Costs

The Economic Policy Institute filed a questionable public comment about New Jersey's proposed independent-contractor rule.

The Economic Policy Institute is a major driver of the freelance-busting brigade. This organization championed California’s Assembly Bill 5, which hurt independent contractors across hundreds of professions. It also pushes the federal Protecting the Right to Organize Act, which would inject California-style freelance busting into federal law, trying to spread it nationwide like a cancer.

Most recently, the Economic Policy Institute just filed a public comment urging New Jersey to firmly embrace freelance busting, too. EPI’s public comment supports the state Department of Labor & Workforce Development’s proposed independent-contractor rule.

This New Jersey public comment should surprise nobody, since the chair of EPI’s board is Liz Shuler, president of the AFL-CIO, and this entire freelance-busting mess is about trying to force self-employed people into traditional, unionizable jobs.

In fact, the only people who testified in favor of this proposal at New Jersey’s public hearing in June were either employed by unions, or affiliated with organizations that have strong union ties. I listed them by name and organization in the 26-page written public comment that I filed on behalf of the grassroots group I co-founded, Fight For Freelancers.

As for the public comment the Economic Policy Institute just filed in New Jersey, it sings all of the union-backed think tank’s greatest hits: employee misclassification, racial and economic justice, and the dream of a world where every worker pays union dues.

Notably, the Economic Policy Institute’s public comment also goes into some depth about the trucking industry, citing its own brand-new research:

“According to our 2025 analysis, a typical truck driver, as an independent contractor, would lose between $12,938 and $21,533 per year in income and job benefits compared with what they would have earned as a W-2 employee. As a W-2 employee, a truck driving job is worth $60,498, while an independent contractor receiving the same wage, but no supplemental pay or benefits earns $38,965—$21,533 less.”

Those are some curious numbers.

I say that because last month, when I testified before the U.S. Senate that the president of the Bi-State Motor Carriers was sitting right behind me, I pointed at a woman named Lisa Yakomin. That’s who was sitting behind me.

And I had in hand a copy of a document that she had given me that morning, just in case any of the senators asked me for specifics about what some of the owner-operator truckers over at the Port of NY&NJ are actually earning these days.

Just A Wee Bit Off

Those of us who attended the public hearing in June about New Jersey’s proposed independent-contractor rule heard a lot of testimony from people involved with operations at the Port of NY&NJ.

The port is a huge driver of economic activity for our state and all across the region, and the testimony from trucking and shipping experts was that operations at the port would be crippled if this proposed independent-contractor rule goes through. It threatens the business model of, among other things, the 77% of port truckers who are independent contractors. Lawmakers who represent the district that includes the port have also come out publicly, raising their own concerns.

All of the testimony about the port at New Jersey’s public hearing in June was so powerful that I wanted to highlight it in my own testimony before the U.S. Senate in July. Yakomin spent a good deal of time working to get real numbers about owner-operator trucker income ahead of that U.S. Senate hearing, not only so I’d have the figures in hand when I testified in Washington, D.C., but also so we could share the information with lawmakers and their aides during meetings afterward.

She received that income information just before the U.S. Senate’s hearing began. She got it from two companies that are among the member firms in her association, all related to trucking at the Port of NY&NJ.

Yakomin’s data shows that quite a few independent-contractor truckers at the port are earning just a wee bit more than the Economic Policy Institute’s public-comment claim of $38,965:

Now, these numbers are gross income, not net, and the owner-operator truckers do deduct business expenses from these figures—but even still, what’s left afterward is nowhere close to the lowball numbers from the Economic Policy Institute.

“Owner-operator truckers tend to be older men and military veterans,” Yakomin explained, citing CloudTrucks. “Due to their close involvement with the day-to-day operation of their companies, owner-operators are statistically safer drivers than company drivers and can earn salaries that are up to 10 times greater than that of company drivers working for private fleets.”

How could the Economic Policy Institute’s findings be so different from the reality that these drivers are experiencing at the Port of NY&NJ?

A big part of the answer lies in the way the Economic Policy Institute’s research is done.

The 11 Occupations Analysis

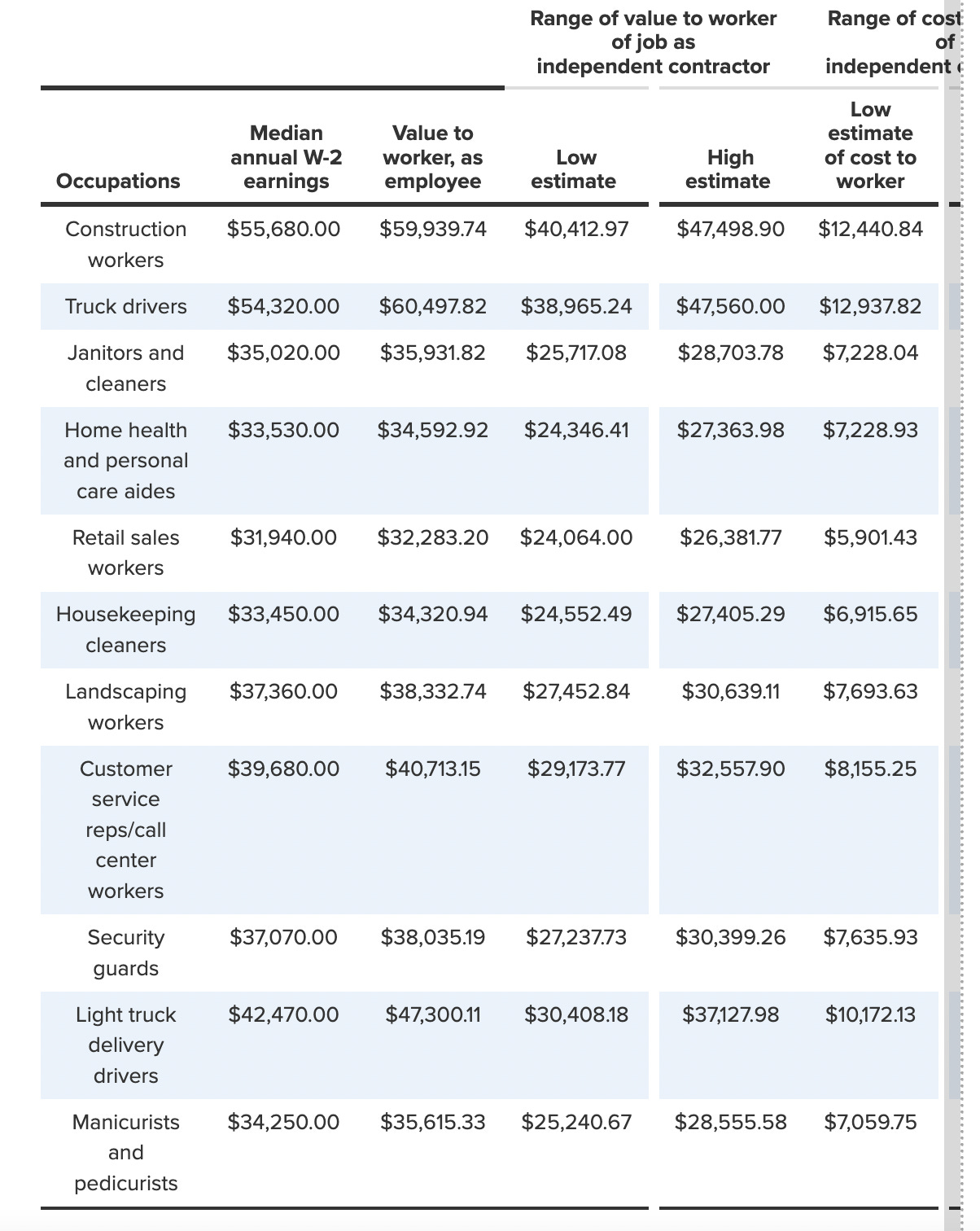

The Economic Policy Institute’s public comment cites this analysis that the organization published about “the cost of independent contractor status for 11 commonly misclassified jobs.”

Now, there’s a reason these 11 jobs were targeted as the basis of the analysis. The Economic Policy Institute essentially went fishing for data in the pools of professions where some opponents of freelance busting actually agree that employee misclassification is more likely to occur:

The first big “but” that should come with this analysis is that a category like “truck drivers” is an oversimplification. There are various kinds of truck drivers (intermodal, flatbed, hazardous materials) just as there are various kinds of writers (grants, screenplays, journalism) and various kinds of translators and interpreters (courts, medical and sign language). And there are categories within the categories. A “light truck delivery driver,” for instance, generally refers to someone who uses a small van or truck to transport packages or goods locally. This can mean anyone from a courier or messenger dropping off envelopes to somebody who is working with a motor vehicle or parts dealer.

Obviously, different types of work that require different levels of skill, equipment investment and certifications are going to command different levels of income. That kind of nuance is nowhere to be found in this 11 occupations analysis.

A second “but” is that the Economic Policy Institute’s own methodology in this 11 occupations analysis states that:

“Since there is no private or public data on workers misclassified as independent contractors, we apply a methodology that makes use of available employee total compensation and earnings data to estimate the costs of misclassification.”

This use of an “estimate” regarding employee misclassification is par for the course with all kinds of research the freelance-busting brigade churns out. People with an agenda of trying to reclassify independent contractors as unionizable employees pay researchers to create such studies, which are actually based on assumptions, but which are later presented to the public as fact.

Just one example of this pattern is the way unionists contracted researchers at Stockton University to study New Jersey’s “underground commercial construction economy.” The researchers actually state in their findings: “we underscore that our own analysis of New Jersey’s underground construction sector should not be interpreted as definitive in nature.”

But then, that research was presented to the public and to legislators as definitive. In that case, the findings were presented to New Jerseyans as fact in the 2019 Report of Governor Murphy’s Task Force on Misclassification.

A similar thing is happening with this 2025 Economic Policy Institute analysis. The methodology section of the 11 occupations study details numerous assumptions that the union-backed think tank made in creating its research. The word “estimate” actually appears eight times in this study’s methodology section.

But in the public comment just filed in New Jersey, the results of the analysis are presented as fact:

“In New Jersey, the costs to workers are significant, particularly for heavy truck drivers and construction workers, who lose between $22,400 and $26,000 per year in compensation as a result of misclassification. In all 11 commonly misclassified occupations, these workers earn between 26% and 37% less than a W-2 employee would earn in the same job.”

The findings are now being used to support what attorneys call an unworkable and unprecedented regulatory shift that targets every single independent contractor in every single occupation all across the Garden State—including in hundreds of professions that the Economic Policy Institute’s researchers never considered at all.

Further to that point, the Economic Policy Institute’s public comment also reveals a strong bias against independent contractors in general, in favor of unionizable jobs:

“Moreover, we have not attempted to place a monetary value on the misclassified worker’s loss of rights guaranteed by the [National Labor Relations Act], including the possibility of union representation. The true costs of misclassification to workers are thus likely even higher than our analysis suggests.”

Fewer than 1 in 10 independent contractors say we’d prefer a traditional job. A full 80% of nonunion employees say they have no interest in joining a union, or are at best neutral on the subject.

Examining the claim that a lack of union representation should be defined as a “cost,” as opposed to a “choice,” would take up an entire working paper of its own.

The Whopper at the End

The last paragraph of the Economic Policy Institute’s public comment, I have to admit, is a masterwork of fictional writing.

It states:

“Strong state-level ABC tests are especially important given the repeated failure of the federal government to adopt consistent policies to prevent misclassification, illustrated most recently by a decision to stop enforcing a new federal rule that had made it harder for employers to misclassify workers as independent contractors under the Fair Labor Standards Act. At a time when some other states and the federal government have bowed to industry pressure and backtracked on commitments to combating misclassification, we support New Jersey’s proposed rule, which exemplifies the state’s continued leadership in preventing exploitative labor practices, protecting state social insurance systems, and leveling the playing field for responsible businesses.”

Let’s take those claims one by one:

ABC Tests that determine independent-contractor status are no longer being used as a worker classification tool. This regulatory language is being edited, finessed and weaponized to hurt most of the independent contractors it affects, and particularly to threaten the incomes and careers of women.

Changing regulatory language about independent contractors is not “important” to anyone but union organizers, because the law currently says they have to leave independent contractors alone. The vast majority of independent contractors prefer our way of earning a living. The entire point of freelance busting is to eliminate this freedom so we will be forced to seek out traditional, unionizable jobs (that we do not want, and that do not currently exist).

Freelance busters like the Economic Policy Institute aren’t targeting us in states like New Jersey because the federal government is being inconsistent; they’re targeting us in the handful of states that still listen to them because the federal government is actively trying to stop this freelance-busting madness at the U.S. Department of Labor and in Congress right now.

The suggestion that “industry pressure” is the only resistance to this kind of policymaking is patently false. Independent contractors ourselves—especially from New Jersey and California—have been raising our voices loudly and clearly for years now about how this freelance busting needs to stop. There was the public hearing in New Jersey in 2019, the testimony before the California Advisory Committee to the U.S. Commission on Civil Rights that was formed in 2020, the Minnesota task force that was formed in 2023, the hearings in the U.S. House of Representatives in 2023 and again in May 2025, the public hearing in New Jersey this past June, and the U.S. Senate Hearing just last month.

The State of New Jersey has not shown anything even remotely like real leadership in this area of labor and employment policymaking. What our government actually did was publish a report about employee misclassification that is so easily debunked, it’s a joke. It then used that report to justify the enactment of 10 new laws, the creation of a new government office, and the granting of unprecedented power to our state’s labor commissioner. And despite all the state’s claims about employee misclassification being widespread, it has only managed to get money back to precious few misclassified employees with this current approach. Its newly proposed independent-contractor rule, according to top attorneys like this one and this one, must be entirely reworked or withdrawn because it’s unprecedented and unworkable. Legislators on both sides of the political aisle say it appears to depart from existing statute and case law, and is a clear attempt to bypass our state Legislature after similar legislative attempts failed. Lawmakers at the State House in Trenton are already preparing to declare the Labor Department’s rule inconsistent with legislative intent.

The Economic Policy Institute’s public comment in New Jersey ends by stating: “The proposed rule will result in significant benefits both for workers and the state.”

Where have I heard something like that before?

Oh, yes: The Economic Policy Institute, back in 2019, called Assembly Bill 5 “an important step forward for workers in California.”

Ask a Californian how things are going for independent contractors out there. And while you’re at it, ask them what their state’s owner-operator truckers are earning, too.

You know, all the occupations in EPI's table are wage-earning jobs that usually don't pay well. If EPI and the others want to cherry pick those low-paying jobs, I'm willing to let them do it. The jobs usually don't pay to risk independent work, anyway. I think they're a drag on our lobbying because our opponents focus on those jobs and not our higher-paying ones. Actually, the jobs are a persuasive argument for unionization, to tell he truth. So, fine. Let the unions have those workers, if they'll leave the rest of us alone.

We can cherry pick, too, by focusing on the higher paying work that most of us do. We can concentrate on our professional, creative and administrative work, which I've read is about 80% of independent contractors. This would undercut the argument that all of us are superexploited and must be "rescued" by being employees. We can demonstrate that we're paid well enough that we don't need the benefits of employee jobs and that we're clever enough to made reasonable decisions about our careers.

What do you think?