The Texas Triangle

In its public comment, the racial-justice think tank Dēmos urges New Jersey to restrict independent contractors because of illegal immigrants near Mexico.

One organization that’s new to me in the public comments filed about New Jersey’s proposed independent-contractor rule is Dēmos. ProPublica shows a New York City address for Dēmos in the organization’s most recent filing with the Internal Revenue Service. Dēmos describes itself as a racial-justice think tank, and its Guidestar description says that for 20 years, Dēmos has “fought the American system of racial capitalism and autocracy.”

The public comment filed in New Jersey is signed by Nick Wertsch, who lists an address for Dēmos in Washington, D.C. According to Wertsch’s bio on the Dēmos website, he previously worked with a Texas organization called the Workers Defense Project. His LinkedIn profile says he also previously worked as an intern for the National Employment Law Project, which is a multimillion-dollar, union-aligned think tank that regularly submits testimony and research about independent contractors to state and federal policymakers. Prior to that, Wertsch’s LinkedIn profile says, he was an intern at the White House during the Obama administration.

According to its 2024 annual report, Dēmos gets its funding from numerous sources including the Ford Foundation, the John D. and Catherine T. MacArthur Foundation and the Robert Wood Johnson Foundation. According to InfluenceWatch, Demos also “receives substantial funding from labor unions and progressive foundations.”

Given all that background, and the fact that Dēmos is a multimillion-dollar think tank unto itself, I suspected there might be some questionable claims in the written comment the organization filed to support New Jersey’s proposed rule-making.

The first two sentences of this comment’s argument suggested that my suspicions would be verified. Its opening salvo states:

“To appreciate the urgency of this problem, it is helpful to understand the scale and scope of the issue. The IRS estimated in 1984 that 3.4 million workers were misclassified, resulting in a revenue loss of $1.6 billion in that year.”

The problem here in the year 2025 is so urgent, apparently, that the most powerful lead-off example of data this think tank could muster is more than 40 years old.

This part of the Dēmos public comment does quote from a couple other sources, including the National Employment Law Project. Specifically, Dēmos cites this study that NELP put out in October 2020—and that in turn cites a questionable 2019 New Jersey report as one of its sources, all of which is a nifty bunch of circular report-writing that I testified about before Congress earlier this year.

Those bits alone are reason enough to challenge the public comment that Dēmos filed in New Jersey, but my eyebrows raised even higher as I kept reading and found myself wandering through a most fascinating bunch of claims that had to do with the State of Texas.

All Hat, No Cattle

The bulk of page two in this four-page public comment that Dēmos filed with the State of New Jersey is not actually about the State of New Jersey, or even about the whole of the United States.

It’s instead specific to the State of Texas. This section of the public comment begins:

"While our partner organizations are not primarily based in New Jersey, their experiences in other states provide an important point of comparison that underscores the value of this proposed rule for protecting vulnerable workers in New Jersey.

“In Texas, for example, a 2024 survey study of more than 350 construction workers documents the pervasiveness of misclassification and its negative impacts not only for workers but the broader community as well.”

Now, at the risk of stating the obvious, a survey of 350 or so construction workers in Texas isn’t exactly ironclad evidence of any problem existing in New Jersey.

But things become downright fascinating when you dig into the citation for this Texas section of the Dēmos public comment.

That citation is this report, called “Behind the Texas Miracle: The Unstable Foundation of the Texas Construction Industry.” Its lead author is the Workers Defense Project—with whom, as mentioned above, Mr. Wertsch of Dēmos previously worked. According to InfluenceWatch, the Workers Defense Project itself works with the Service Employees International Union and the AFL-CIO.

“Behind the Texas Miracle” is a 22-page report about the construction industry in Texas based on interviews with 353 people working on construction sites. The report states that interviewers went to these sites, screened out everyone who actually owned their own construction companies, and then gave $15 gift cards to people they spoke with for about 15 minutes apiece.

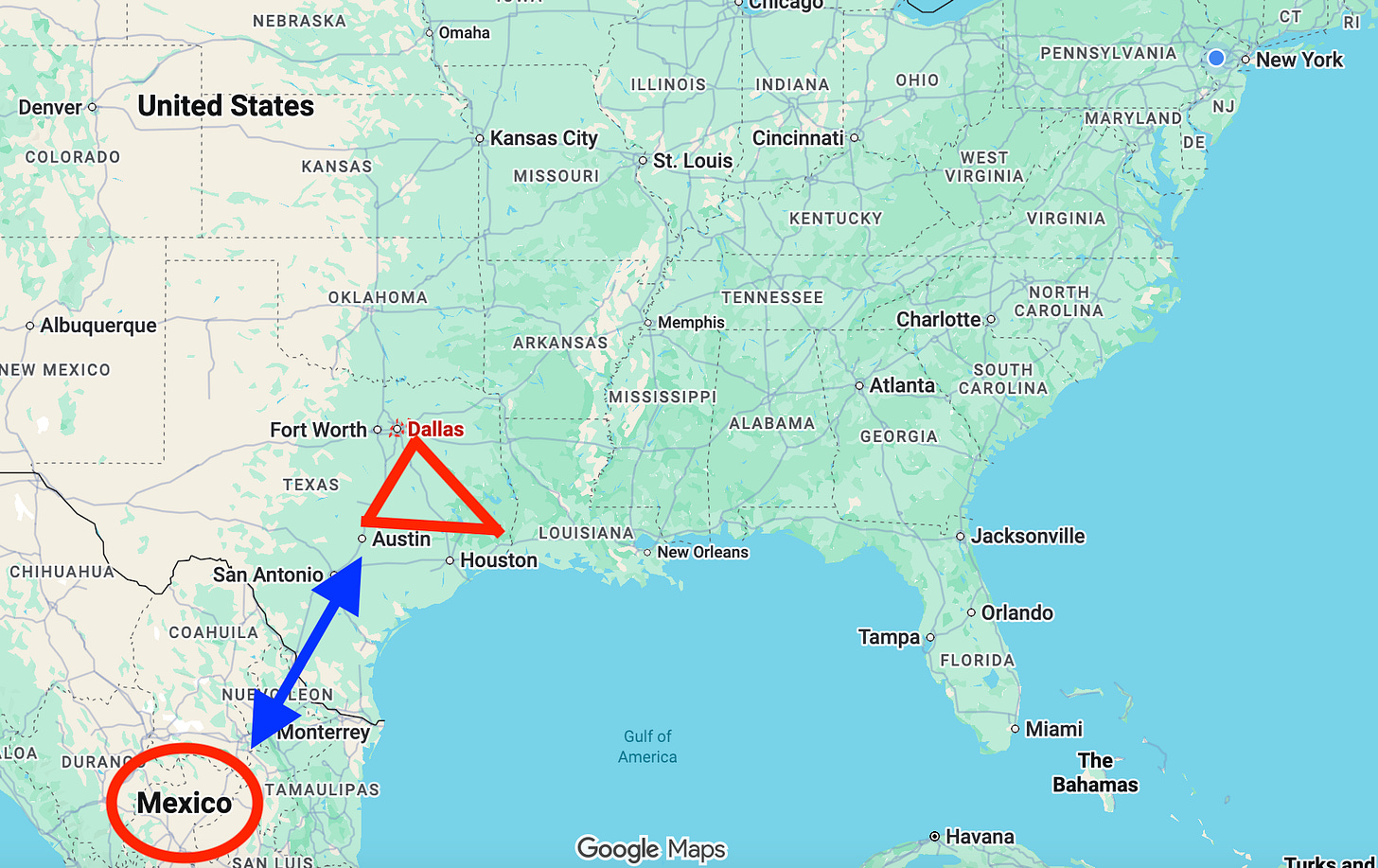

These interviews were done in the part of Texas near the metropolitan areas of Austin, Dallas, Fort Worth and Houston. As the report’s authors write, “these cities frame much of the ‘Texas Triangle,’ the fastest-growing area of the state—and one of the most important construction markets in the United States.”

The Texas Triangle also happens to be in a location that’s pretty darn close to the U.S. border with Mexico. This part of Texas is not only more than 1,500 miles away from New Jersey, but it’s also a place where, you may have heard on the news, there’s been a bit of an illegal immigration problem in recent years:

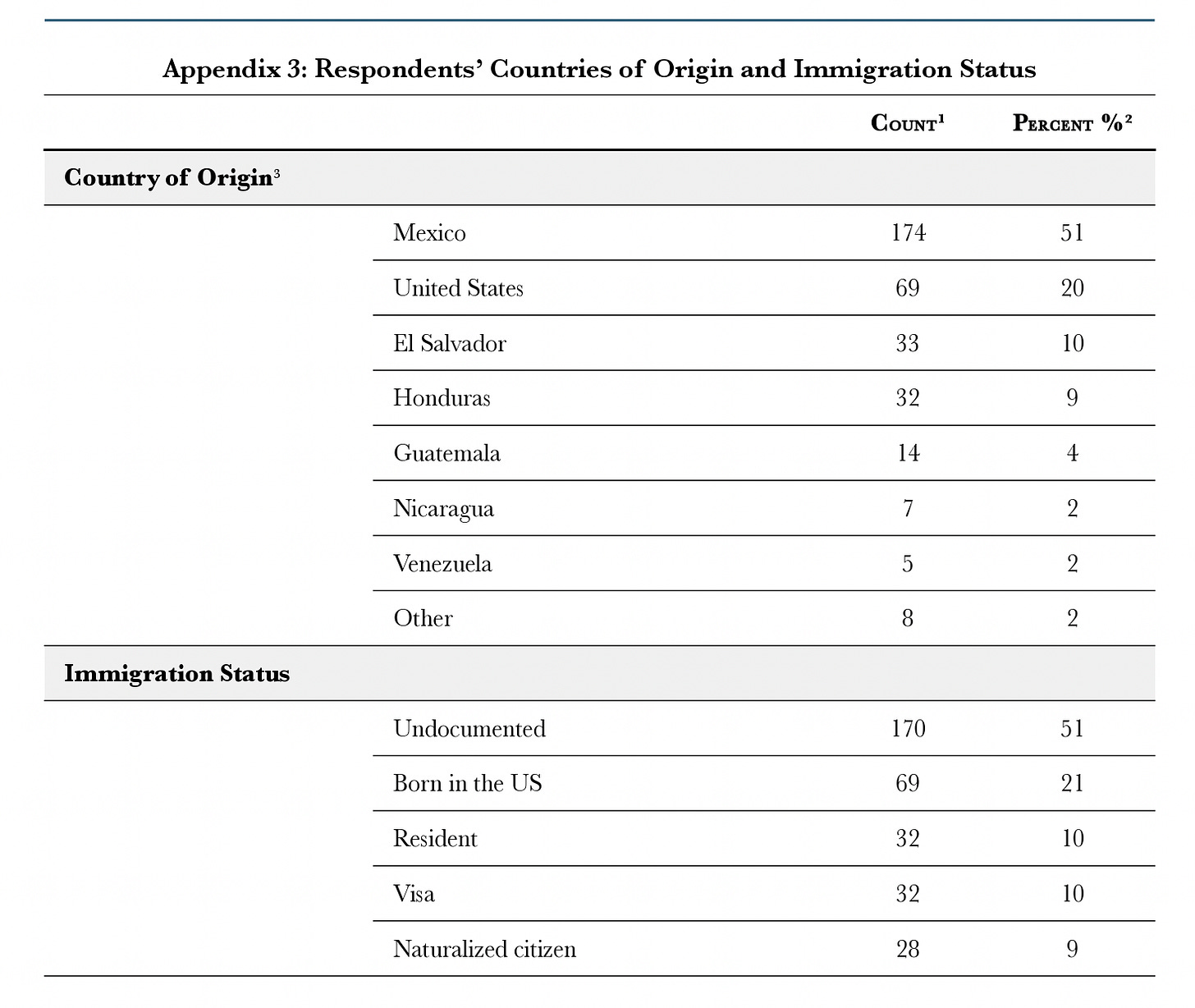

All of which helps to explain why, in the Texas report’s appendix section, the authors describe more than half of the people they surveyed as being undocumented immigrants, mostly from Mexico and Central America:

Equally interesting to me is the section on page nine of the Texas report that begins with this:

“Nearly one in five (18%) respondents indicated that their employer issues them a 1099 tax form (for independent contractors) …”

Eighteen percent of 353 people is 63 people—so we’re actually talking about a survey that involves just 63 people who are classified as independent contractors in Texas.

And even more notable is that the Texas report provides zero evidence that even a single one of those 63 people is a misclassified employee. Instead, the authors themselves wrote that what they documented warrants further investigation:

“Nearly one in five (18%) respondents indicated that their employer issues them a 1099 tax form (for independent contractors), and 10% are not issued any tax documents at all. In addition, more than one in five (22%) respondents are paid ‘off the books,’ through methods of payment such as cash, cash transfer mobile applications, prepaid debit cards, or personal checks. Employees should be receiving W 2 forms and having taxes deducted from their pay. The varied pay arrangements reported by respondents raise questions about the pay practices that exist in the industry and warrant further investigation.”

In other words, the public comment that Dēmos filed in New Jersey about independent-contractor policy—claiming that this Texas survey “documents the pervasiveness of misclassification”—is more accurately described as documenting the problem of illegal immigration and an underground cash-based economy near the U.S.-Mexico border.

Which is, of course, a real problem, one that we’ve all heard a thing or two about the federal government taking significant steps to address in recent months.

They’re Ba-aaack

As if that’s all not enough of a highly debatable hootenanny, the public comment that Dēmos filed in New Jersey then moves into its last full page, with this passage being its grand finale argument:

“Within the construction industry, New Jersey has one of the highest rates of estimated wage theft and underpayment due to misclassification. A 2025 assessment found that a misclassified construction worker in New Jersey is underpaid by $13,808 to $22,442.8 It is estimated that, on average, more than 18% of New Jersey construction workers (49,294 workers), allowing low-road employers to avoid more than $531.3 million in costs and costing taxpayers $329.3 million each year.”

The citation for that part of the Dēmos public comment is this research by the Economic Policy Institute. It’s a Washington, D.C.-based think tank chaired by Liz Shuler, who is the head of the AFL-CIO—an organization that demonstrated in its own New Jersey public comment that it cannot discern the difference between someone with six minimum-wage part-time jobs and a six-figure freelancer doing projects for six different clients wherever, however and whenever she chooses.

This 2025 Economic Policy Institute report that the Dēmos public comment cites, as I detailed here, is based on a whole bunch of the union-backed think tank’s estimates. That report’s authors actually included the caveat that “there is no private or public data on workers misclassified as independent contractors.”

Which brings us to the way Dēmos, in its New Jersey public comment, sums up all of this so-called evidence it has presented, before it urges the Labor Department to move ahead with its proposed independent-contractor rule:

“With this understanding of the national problem of misclassification and its deeper impacts within states and industries, it is important to consider the potential solutions—and New Jersey’s proposed regulation would provide much needed clarity for workers, businesses, and courts to accurately classify workers and hold low-road employers accountable.”

No other “industries” are even mentioned in this public comment. And who, exactly, these alleged low-road employers are in New Jersey is a total mystery.

One More Time, with Feeling

I have written numerous before, and I’ll write here again, that companies cheating their employees should be held accountable.

Specific to the construction industry, I will also state again that I was born in New Jersey. I was raised here. I’ve been a homeowner here for decades. Based on what I see, plenty of construction companies have workers who aren’t from the United States. I have no doubt that if you poke a stick into that industry, you’ll find people who should be classified as employees, but who take cash under the table because they aren’t here legally, and they don’t understand a word of English.

But there is a difference between targeting actual cases of employee misclassification—or addressing problems of illegal immigration—and trying to rewrite New Jersey’s rules affecting an estimated 1.7 million independent contractors. Especially when the Labor Department’s proposal, numerous attorneys say, “almost entirely eviscerates” any chance of establishing independent-contractor status; is “fundamentally flawed from a legal perspective”; is “an existential threat to flexible, independent work”; and “warp[s] the explicit statutory language and court precedent.”

You can read the four-page Dēmos public comment in full here, and draw your own conclusions:

In my opinion, the Dēmos public comment says more about Dēmos than it does about anything else. Which is not surprising to those of us who have been fighting to stop freelance busting for years now, and who are standing shoulder to shoulder across all kinds of professions in 99% opposition to this proposed New Jersey rule-making.

We may not be part of some fancy, multimillion-dollar think tank in Washington, D.C., but this sure as hell ain’t our first rodeo, either.