Lawyers, Money and the Mob

This comment urges New Jersey to restrict independent contractors in part because of how organized crime infiltrated the Teamsters.

There have been some fascinating finds within the two dozen or so public comments filed in support of New Jersey’s proposed independent-contractor rule, which is facing 99% public opposition. The handful of supporters include:

The union-aligned National Employment Law Project, which cited data as old as 1984.

The New Jersey AFL-CIO, which was unable to distinguish the difference between being your own boss and having multiple part-time jobs.

The racial-justice think tank Dēmos, which argued that New Jersey should restrict independent contractors because of illegal immigration in Texas.

Human Rights Watch, which cited a study that averaged just seven people per state, and none of them in New Jersey.

A number of unions that made sweeping claims with little or no evidence to back them up.

Today, I invite you to read the public comment that the New Jersey Association for Justice filed in support of the proposed independent-contractor rule:

This organization describes itself as “a professional organization of over two thousand attorneys, paralegals, law students and other advocates who are dedicated to the protection of the legal rights of individuals and the preservation of the civil justice system.”

Its five-page public comment argues, among other things, that New Jersey’s Department of Labor & Workforce Development should move forward with its independent-contractor rule because of the way the mob infiltrated the Teamsters union about a half century ago.

‘The Big Fixer’

This public comment from the New Jersey Association for Justice is, in many ways, standard for the freelance-busting brigade. It talks about misclassified workers and makes a number of significant claims without any citations or evidence to support them, such as stating that:

“Companies put profits over safety by flagrantly disregarding U.S. Department of Transportation requirements that mandate certain hours off for truck drivers.”

“Being labeled an independent contractor often means workers have little control over their schedules, workloads, or job terms, despite being treated as ‘self-employed.”’

“Studies show that gig workers often prefer employee status for stability when guaranteed fair wages. Anecdotally, many workers misclassified as independent contractors would prefer to be employees, rather than be subject to exploitation.”

Statements like those are throughout this public comment, which does not contain even a single footnote as attribution for the claims.

The worldview that underpins this public comment is evident from its first paragraph of argument, which states:

“Legally designating a worker as an ‘employee’ under the law is the only way to prevent worker exploitation.”

Only is a strong word. The implication is that all independent contractors are at best targets for exploitation.

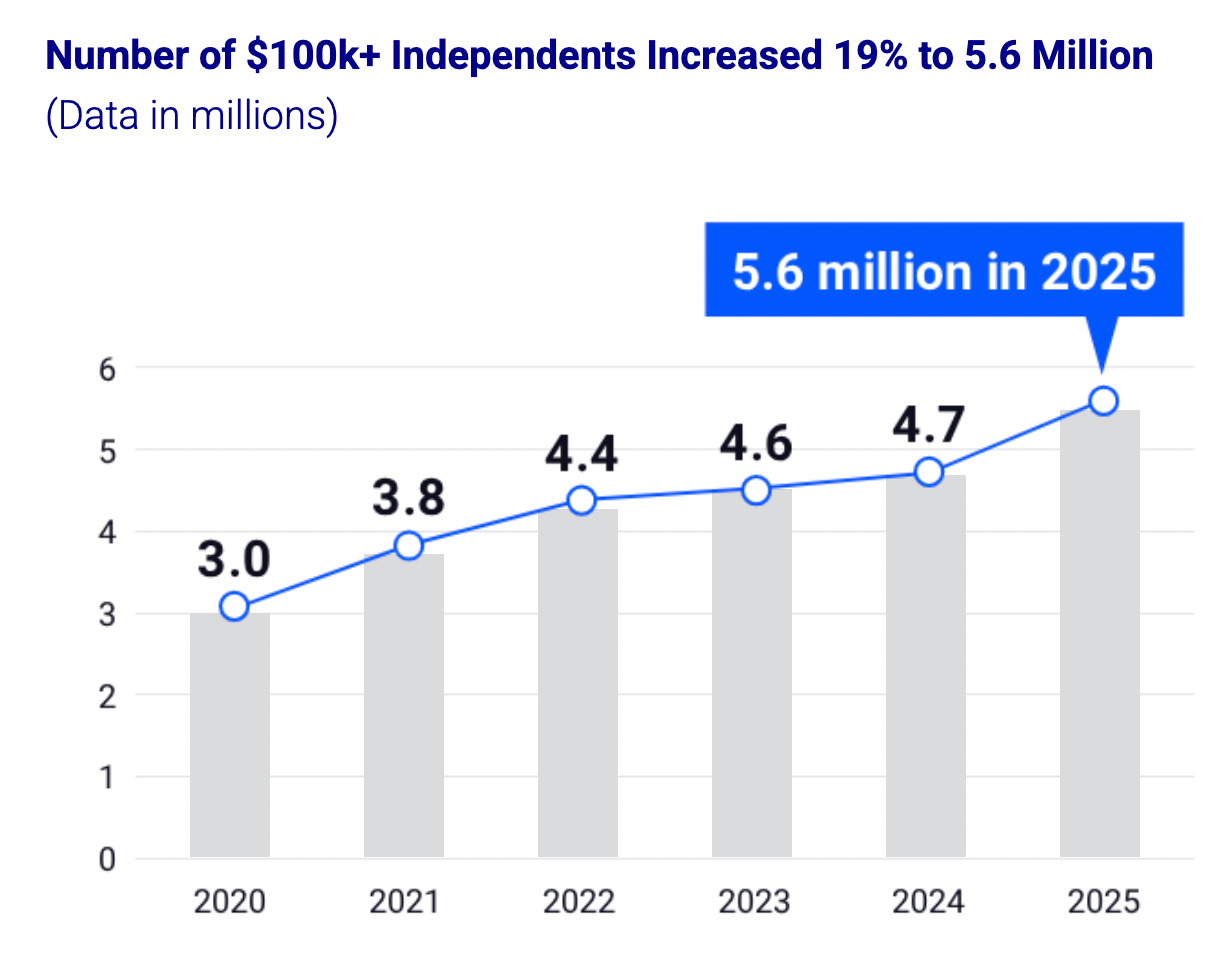

That’s a tough statement to defend in a nation where government research shows 80% of independent contractors prefer our way of working; where people with multiple streams of income can have the power to walk away from bad companies altogether; and where the latest MBO Partners research shows that 5.6 million independent contractors earn more than $100,000 a year:

The New Jersey Association for Justice instead cites the questionable 2019 Report of Gov. Murphy’s Task Force on Misclassification as further basis for its claims. This public comment then goes on to state that some companies are violating New Jersey wage payment law—which is accurate on its face, but doesn’t necessarily require any change in independent-contractor policy to allow for enforcement.

Now, as I wrote above, this kind of stuff is normal enough with the freelance busters. But the next argument this public comment makes is by far the most original that I have seen in a long time:

“The history of worker misclassification has a sordid history in the state of New Jersey. The practice began with organizes [sic] crime-controlled entities that undercut union truck drivers by the use of independent contractor drivers, which led to lower pay and flouting of worker protection laws.”

This claim is followed by a link to a half-hour YouTube video, which is a compilation of a three-part TV news series from 1979 about allegations that the mafia had infiltrated the Teamsters union.

Largely, this series centers on a man named Eugene Boffa, Sr., described here as “The Big Fixer.” He was, in real life, tied to Frank Sheeran, the guy Robert De Niro played in Martin Scorsese’s film The Irishman.

This whole era involved accusations of breaking laws well beyond labor and employment. Like racketeering, murder, arson and embezzlement. And, if you didn’t guess as much from the video quality, it all happened a really long time ago. So long ago, in fact, that the notorious Teamsters headquarters building from back then in Union City, N.J., made headlines recently because of plans to renovate it as modern affordable housing.

And all the horrible things in that TV news report from 1979 also happened to people who were supposedly protected, unionized employees. National Review reported in 2024 about what ended up being decades of criminal investigations that involved the Teamsters union:

“… that mess existed for decades, as thousands of Teamsters members had money stolen from them and their physical safety threatened so that corrupt union bosses and organized-crime leaders could maintain their power. That’s no way to run an industry, and it’s no way to protect workers.”

New Jersey has 20,500 CPAs

As fascinating as that digression is about the mafia back in the day, the New Jersey Association for Justice public comment also goes on to claim that today’s independent contractors are exploited because, I guess, we cannot possibly locate an accountant in a state that has tens of thousands of them.

The public comment says instead, about misclassified employees:

“Additionally, they must navigate complex tax filings without the support of an employer’s HR department, increasing the risk of errors and penalties.”

Perhaps the exploited, misclassified workers this public comment describes cannot afford an accountant, but in those cases, New Jersey’s Division of Taxation offers free tax preparation services for certain individuals, including those who are low-income and non-English-speaking.

There are numerous other notable statements in this public comment, including a claim that misclassified employees can’t exercise their rights because they may be deported:

“Workers may be unaware of their rights or hesitant to report violations due to fear of job loss or deportation, particularly in industries with high immigrant labor.”

Deportation is, of course, a valid concern if you’re an illegal immigrant. In which case labor and employment law are not currently the government’s top focus with regard to your situation.

My favorite part of the remaining claims in this public comment is this next one. It’s toward the end, about states that use ABC Test regulatory language to determine independent-contractor status:

“It is indisputable that states with the strongest economies (such as California, Massachusetts and Illinois) have the strongest worker protection laws-including the ABC Test.”

Certainly, there are ways to argue that those states’ economies are strong. However, the California Legislative Analyst’s Office recently reported that “California’s economy has been in an extended slowdown for the better part of two years, characterized by a soft labor market and weak consumer spending. While this slowdown has been gradual and the severity milder than a recession, a look at recent economic data paints a picture of a sluggish economy. Outside of government and health care, the state has added no jobs in a year and a half.”

And the overall size of an economy, arguably, is not the best metric to consider when talking about labor and employment policy.

According to the U.S. Bureau of Labor Statistics, California is currently the state with the worst unemployment rate in the nation. Massachusetts is in the bottom 10 too, while Illinois just missed that cutoff, skidding in at No. 13 for unemployment among the 50 states.

Specific to independent contractors in California in the past five years, research from the Mercatus Center showed that enacting the ABC Test law “resulted in a significant decline in self-employment and overall employment”:

Self-employment decreased by 10.5% on average for affected occupations

Overall employment decreased by 4.4% on average for affected occupations

I’d also encourage you to read about the public comment that the economist from the Mercatus Center filed here in New Jersey. She did a new analysis showing that the way our state is currently interpreting ABC Test regulatory language has already led to the following outcomes, compared with states that do things differently:

a 3.81% decrease in W-2 employment

a 10.08% decrease in self-employment

a 3.95% decrease in overall employment

That economist told me: “… the empirical patterns could be suggestive of an ‘overkill effect,’ where legitimate independent contractor relationships are systematically disrupted.”

Systematically disrupting people’s livelihoods could also be a reasonable way to describe what happened to those rank-and-file Teamsters union members who became victims of the mob back in the day.

Which made me wonder if there might be some kind of big money in play with the New Jersey Association for Justice—not necessarily involving the mob, of course, but perhaps involving powerful people in Trenton.

Here’s the Money

The New Jersey Association for Justice public comment definitely says a lot of things, but there is also one important thing the comment leaves out.

This group is affiliated with a political action committee called the New Jersey Association for Justice PAC. According to the database of New Jersey’s Election Law Enforcement Commission, NJAJ PAC doles out a good bit of cash to politicians in Trenton. Including to top-ranking lawmakers in the state.

The person who signed the New Jersey Association for Justice public comment is Jonathan H. Lomurro, Esq., the organization’s president and a trustee of NJAJ PAC. He’s a trial attorney whose website states that he specializes not in labor or employment law, but instead in medical malpractice and personal-injury cases. His law firm touts numerous multimillion-dollar verdicts and settlements over the years for motor vehicle accidents, slips and falls, and more.

Lomurro’s LinkedIn bio notes how he got his start: as a pool attorney in the Office of the Public Defender.

New Jersey’s Office of the Public Defender also happened to file a public comment. It opposes the Labor Department’s proposed independent-contractor rule. The Public Defender’s comment describes how, if the this rule-making goes forward, the office will have a hard time using pool attorneys—because pool attorneys are independent contractors.

Talk about a mess that needs a big fixer.