This Is Basic Math

New Jersey's unemployment rate is up. Companies will not magically create new jobs for the state's estimated 1.7 million independent contractors.

Last week, the U.S. Bureau of Labor Statistics announced that New Jersey’s unemployment rate had increased to 5.2 percent. The New Jersey Business & Industry Association was quick to point out that this means my home state now has the fourth-highest jobless rate among all states in the nation. The New Jersey Department of Labor & Workforce Development noted that total nonfarm employment in the state stands at 4,401,800 jobs.

Everyone should be thinking about these figures in the context of the Labor Department rule proposal that’s threatening the incomes and careers of the state’s estimated 1.7 million independent contractors.

The math on this rule proposal isn’t even hard.

And it adds up to big trouble for our state’s economy and workforce.

The ‘Jobs Impact’ Admission

When regulators or lawmakers impose overly restrictive independent-contractor policy, it doesn’t magically create traditional W-2 jobs. What it does, with the stroke of a pen, is create a situation where the government tells companies that if they continue to work with independent contractors, then they may face fines and penalties.

This is an important point that I think often gets lost in the independent-contractor policy debate. The freelance-busting brigade likes to talk about “reclassifying independent contractors as employees”—implying that all kinds of traditional W-2 jobs will suddenly be created after contractors are reclassified on paper as employees.

But what actually happens in most cases is that existing independent-contractor business relationships are destroyed. Companies fear government fines, and they cut ties with independent contractors. The incomes and careers that independent contractors have built get wiped out.

Beyond that, there are zero guarantees. There’s not even any kind of decent odds that new W-2 employee roles will be created for us. Especially not at a time when unemployment is on the rise.

New Jersey’s own Labor Department acknowledges this fact in its rule proposal. The Jobs Impact section states unequivocally that this proposal will not create any jobs.

We also know this is true because of what happened in California. When that state implemented this type of overly restrictive independent-contractor policymaking a half dozen years ago, the state’s nonpartisan Legislative Analyst’s Office wrote that instead of converting independent contractors to employee-type jobs: “businesses may decide to stop working with their California-based contractors.”

All these years later, that is the most widespread, documented outcome of California’s failed freelance-busting experiment: the destruction of existing business relationships and independent-contractor income.

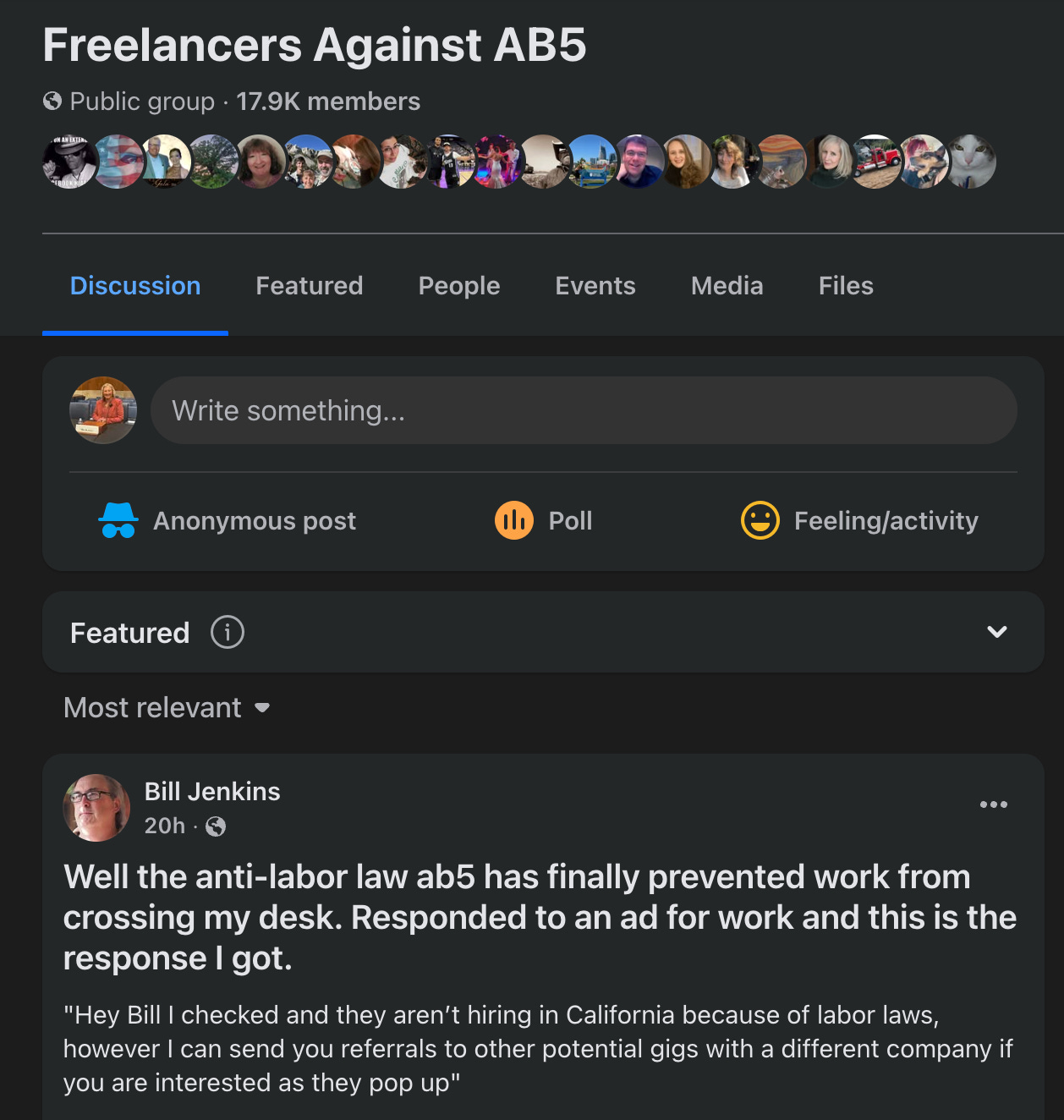

Our fellow freelancers out in California are still enduring that reality to this day. Just last week, yet another post went up from a frustrated member of the Facebook group Freelancers Against AB5 :

All of which is why there are an estimated 9,500 public comments on file right now at New Jersey’s Labor Department, with 99% of them opposed to the proposed independent-contractor rulemaking.

We all know what’s going to happen if this rule is finalized. The state Labor Department has admitted what will happen. Its own proposed rule says the quiet part out loud about what comes next.

Attorneys have made clear six says from Sunday that our existing incomes and careers as independent contractors will be destroyed. Two dozen sitting legislators have raised their voices to express concerns.

Yes, employee misclassification is wrong, but it’s equally wrong to reclassify independent contractors right out of business.

And that’s what the attorneys say is happening in New Jersey. This is weaponizing regulatory language to attack independent contractors.

‘Disproportionate Impacts on Women’

Governor Phil Murphy laughed out loud at the widespread opposition to this proposed Labor Department rulemaking. It’s a response that is, in a word, unacceptable.

He must have missed the report that members of the California Advisory Committee to the U.S. Commission on Civil Rights issued, citing significant evidence of the disproportionate and negative impacts this kind of overly restrictive independent-contractor policymaking has on women, immigrants, people of color and the politically powerless.

Similarly, there’s a public comment on file at New Jersey’s Labor Department right now from economists at the Mercatus Center, whose research shows that the Garden State’s approach to independent-contractor policy has already led to harmful effects compared to states that do things differently:

a 3.81% decrease in W-2 employment

a 10.08% decrease in self-employment

a 3.95% decrease in overall employment

And the Mercatus economists also noticed a disproportionate, negative impact on women:

“[T]he New Jersey data reveals stark gender disparities: women’s traditional W-2 employment declined by 7.40%, while men’s showed no significant change—raising concerns about disproportionate impacts on women following the policy change.”

Why would that be true? Simple: because women are more likely to be independent contractors than we are to own businesses that have employees.

That’s according to U.S. Census Bureau data, which shows that while women own just 22.3% of employer firms, women own 42.7% of nonemployer firms.

When government policies threaten independent contractors, they are inherently more likely to harm women entrepreneurs.

Call Your Lawmakers

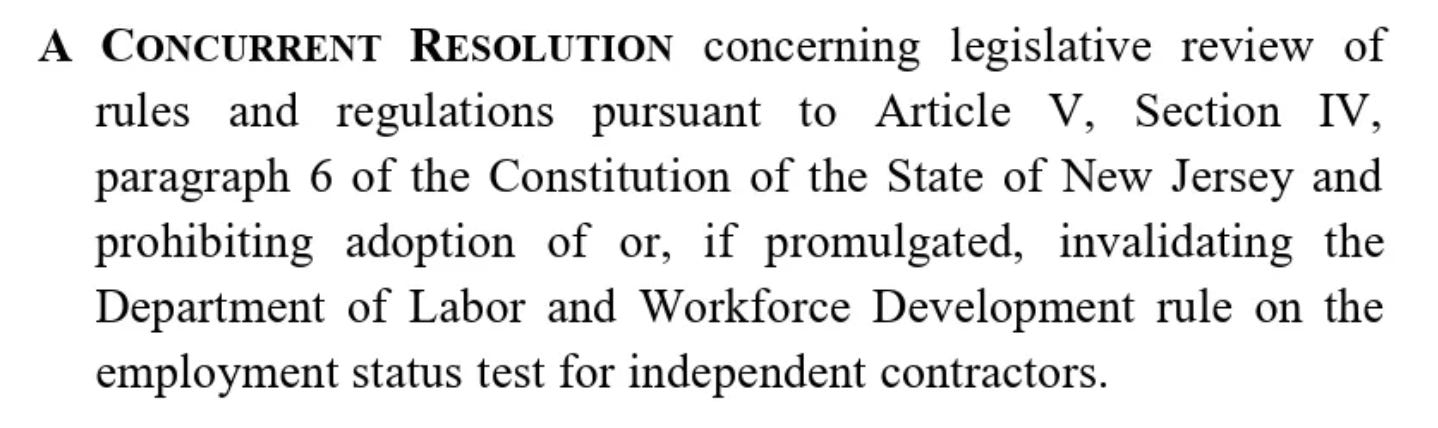

I continue to hope that New Jersey’s Legislature will take action to protect us all from this madness. It was terrific last week when state Assemblywoman Vicky Flynn introduced Assembly Concurrent Resolution 177. It’s identical to the previously introduced Senate Concurrent Resolution 138 from Senator Declan O’Scanlon.

ACR177 and SCR138 would declare the proposed independent-contractor rule inconsistent with legislative intent, prohibiting its adoption and/or invalidating it.

Assemblywoman Flynn posted on X late last week, asking everyone to contact our legislators and ask them to help stop the Labor Department’s overreach. Right after I saw her post Friday afternoon, I emailed my own state Senator and two Assembly members and asked them to co-sponsor SCR138 and A177.

I hope everyone else in New Jersey will do the same. If you’re in the Garden State but don’t know who represents you, go here and click on your town in the drop-down menu. It will lead you to a contact page for your district’s legislators.

Yes, I know, it’s ridiculous that we are still being forced to fight for our fundamental freedom to earn a living. But this is where things stand.

That math is simple too. SCR138 and ACR177 are going to need a lot of votes in the state Legislature, from Democrats and Republicans alike.