The Valuable Consideration

There's now legislation to protect New Jersey real-estate brokers, in addition to a bill for truckers, insurance producers and investment advisers.

As I wrote earlier this month, New Jersey’s Legislature is back in session now, and anybody who can get the ear of a lawmaker in Trenton is trying to gain protection against the proposed independent-contractor rule at New Jersey’s Department of Labor & Workforce Development.

The good news is that on November 10, Republican state Senator Declan O’Scanlon introduced a concurrent resolution, SCR138, that would prohibit adoption of the Labor Department’s rule, or would invalidate the rule if it’s promulgated. This concurrent resolution would cover all of the estimated 1.7 million New Jerseyans whose incomes and careers are being threatened. SCR138 is intended to protect us all from the Labor Department’s current attempt at widespread freelance busting.

However, New Jersey legislators are also introducing bills—there’s more than one now—that would shore up protections only for certain professions.

With every individual-profession bill, New Jersey moves closer toward a repeat of the Swiss-cheese stupidity we all witnessed in California. Every conceivable profession ended up being tossed into in a scrum for exemptions from the senseless freelance busting that should never have happened in the first place.

After the fact, members of the California Advisory Committee to the U.S. Commission on Civil Rights held hearings and then issued a report that warned other states to “avoid some of the pitfalls that California fell into,” including “rushing into the adoption of the ABC test and politicizing the exemption process.” The report also cites specific concerns about disproportionate and negative impacts on women, immigrants, people of color and the politically powerless.

And yet, despite California being such a blinking-red cautionary tale when it comes to independent-contractor policy, New Jersey continues to flirt with that same deeply misguided policymaking path.

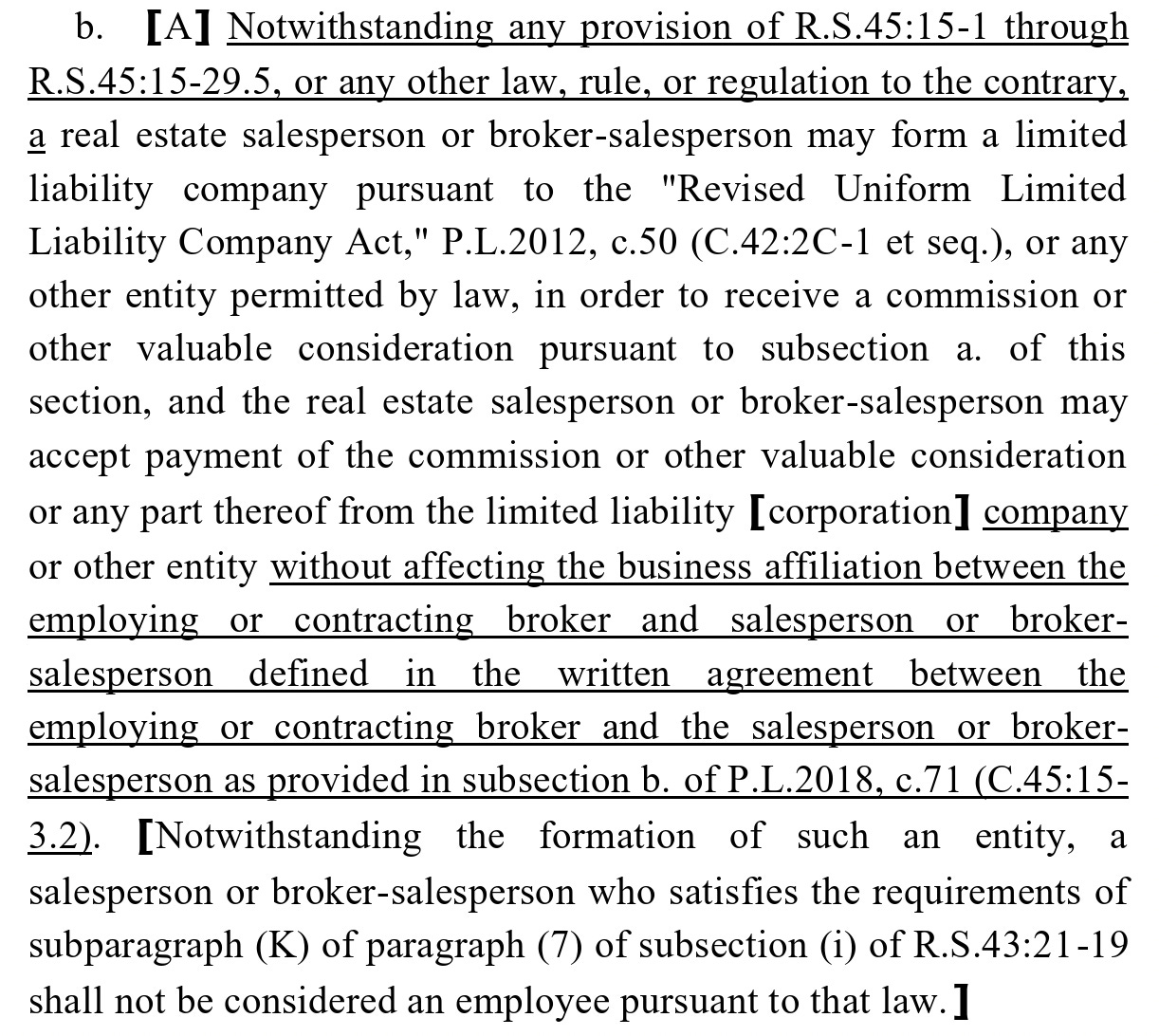

S4889 and A5978

Earlier this month, we saw the introduction of New Jersey Senate bill 4839. Its sponsor is state Senator Gordon Johnson, a Democrat who chairs the Senate Labor Committee. This bill applies to certain truckers, insurance producers and investment advisers who already appear to be covered by federal regulations.

As of November 20, we also have Senate bill 4889 sponsored by Joe Lagana, a Democrat who chairs the Senate Commerce Committee; and the companion Assembly bill 5978 from Sterley Stanley, a Democrat who chairs the Assembly Regulated Professions Committee.

These bills would allow real-estate salespeople and brokers to accept payment of a commission or other valuable consideration without affecting their business affiliation, notwithstanding any other law, rule or regulation.

Introduction of these real-estate industry companion bills comes after a public comment that New Jersey Realtors filed with the Labor Department, stating that the proposed independent-contractor rule “is not accurate for the real estate brokerage industry.”

There’s also a public comment from NAIOP, the commercial real estate association, that urges the Labor Department to rescind its proposed rule. That comment states:

“[W]e believe the proposal would have far-reaching consequences, negatively impacting NAIOP NJ members in all asset classes as it relates to all aspects of commercial real estate development and property management.”

Here is the two-page NAIOP comment in full:

Real estate is just one among many industries that are represented in the estimated 9,500 written public comments on file with the Labor Department, expressing 99% opposition to the proposed independent-contractor rule.

Opposition comments are also filed by attorneys who call the proposed rulemaking an existential threat to independent work that almost entirely eviscerates anyone’s chance of establishing independent-contractor status in the state.

Please, Protect Us All

I continue to hope that legislators from both sides of the aisle will support SCR138 to protect us all from this freelance busting—especially legislators like Senators Johnson and Lagana, and Assemblyman Stanley, who have publicly stated that they see potential negative consequences for all kinds of New Jerseyans from the Labor Department’s proposed rule.

On June 4, Senators Johnson and Lagana were among three committee chairmen who wrote to New Jersey’s Labor Commissioner, expressing concern that the proposed independent-contractor rule “departs from the existing statute and case law controlling worker classification.”

Here is that letter in full:

Similarly, on July 31, Assemblyman Stanley was among several lawmakers who wrote to the Labor Commissioner, citing “wide-ranging and substantive” concerns with the proposed independent-contractor rulemaking.

Here is that letter in full:

For all the reasons these letters make clear, we need New Jersey’s Legislature to pass SCR138 and protect us all from the Labor Department’s proposed independent-contractor rule.

And then, ideally, we need our legislators to take action so this kind of threat to our state’s workforce and economy can never happen again.