The Golf Caddie Bill

A hearing is now scheduled in Trenton for this single-profession legislation that would protect caddies' independent-contractor status.

Back in December 2021, there was a hearing at the New Jersey State House on a bill that would have protected the independent-contractor status of golf caddies, and golf caddies alone.

As I testified during that hearing, this bill was an “egregious example of playing favorites that has absolutely no business being part of our legislative process.” I testified about all the people who had gone to Trenton and testified in December 2019 about needing protection for our independent-contractor status, too—from musicians and tutors to freelance writers and owner-operator truckers.

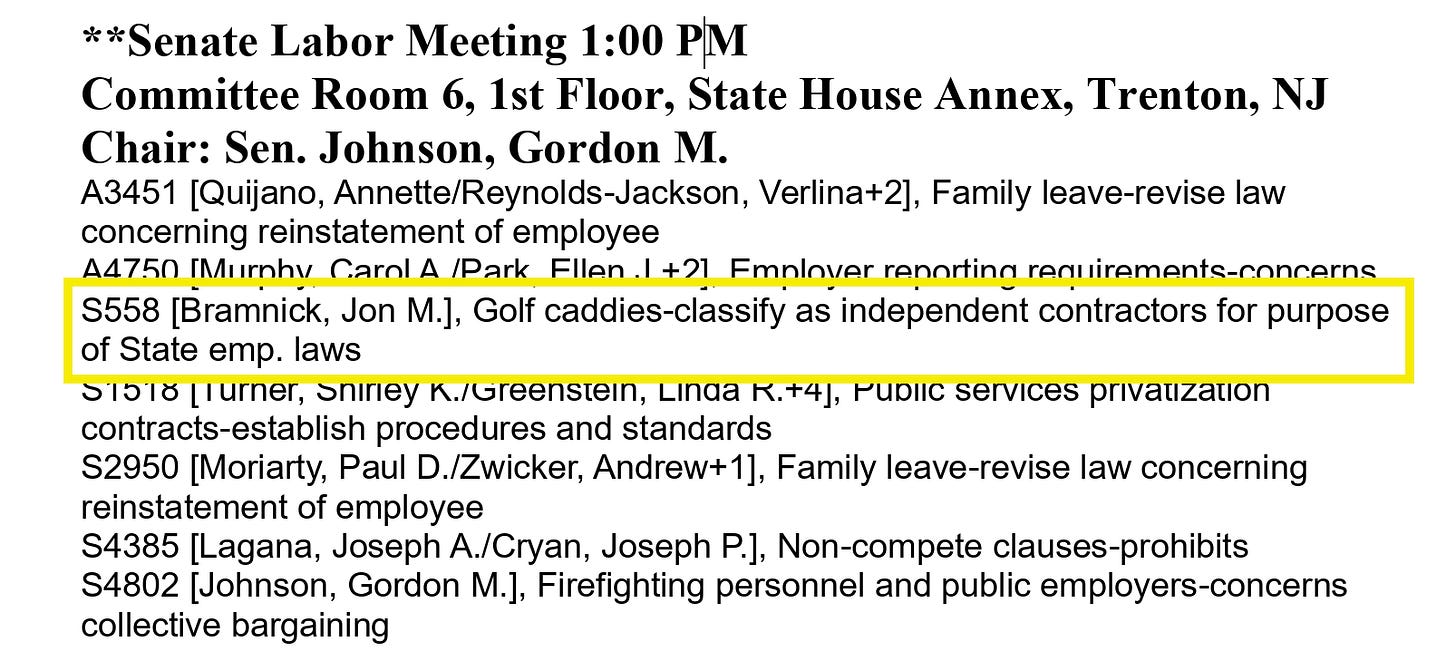

Well, that golf caddie bill is now back in play, as Senate Bill 558.

The golf caddie bill was just scheduled for a hearing on December 1 before the New Jersey Senate Labor Committee. The sponsor is Republican Senator Jon Bramnick.

This hearing comes after the New Jersey State Golf Association and the Western Golf Association jointly filed a public comment with the New Jersey Department of Labor & Workforce Development about the Department’s proposed independent-contractor rule.

That public comment specifically cites this bill:

“In agreement with the WGA and NJSGA, the New Jersey Legislature has been unwavering in its support for the position that caddies should be classified as independent contractors, exempt from various state employment laws. In fact, in the 2021–2022 legislative session, both houses of the New Jersey Legislature unanimously passed Bill A6033, which classified golf caddies as independent contractors for the purposes of state employment laws. While Bill A6033 was ultimately pocket vetoed by Governor Phil Murphy on January 18, 2022, the Legislature’s intent was clear: caddies are properly classified as independent contractors in the State of New Jersey. This intent was again demonstrated in the recent 2024–2025 legislative session, where another bill, Senate, No. 558, was introduced by Senator Jon Bramnick and referred to the Senate Labor Committee. This bill again provided that golf caddies in the state should be classified as independent contractors and exempt from various state employment laws. While Senate, No. 558 has yet to be voted on by the Senate, the continued efforts by the New Jersey Legislature to codify what is already the standard practice of golf clubs in the state sends a clear signal that lawmakers agree that golf caddies are independent contractors.”

As I have written many times before, with every individual-profession bill that gets introduced, New Jersey moves closer toward a repeat of the Swiss-cheese stupidity we all witnessed in California.

Every conceivable profession there ended up being tossed into in a scrum for exemptions from the senseless freelance busting that should never have happened in the first place.

‘Devastating Economic Consequences’

I continue to hope that legislators from both sides of the aisle will support Senate Concurrent Resolution 138, which Republican Senator Declan O’Scanlon introduced to protect us all from the Labor Department’s attempt at widespread freelance busting.

My hope especially applies to legislators like Senator Bramnick, who issued a statement on August 18 that makes clear he understands the potential for all kinds of independent contractors to suffer harm:

“Senator Jon Bramnick (R-21) announced his opposition to the Murphy administration’s proposed Department of Labor rule change for independent contractors, citing devastating economic consequences on both workers and families.

“‘This rule change will drive small businesses owners out of New Jersey, plain and simple,’ said Sen. Bramnick. ‘By misclassifying thousands of independent contractors as employees, the Labor Department would strip away the flexibility and freedom that make these professions possible. The result will be lost jobs, higher costs, and fewer opportunities for residents.’

“The proposed rule change seeks to reinterpret the long-standing ‘ABC Test,’ threatening to reclassify thousands of independent contractors—including financial advisors, rideshare drivers, truckers, freelances, [sic] and others—as employees. This would trigger increased payroll tax obligations for companies, in addition to upheaving independent business models.

“An FSI-Oxford Economics study revealed that 65% of financial advisors would consider relocating out of New Jersey if the DOL rule changes were to go into effect. This alone would lead to a loss of an estimated loss of 4,670 workers and $470 million in GDP.”

For all the reasons that Senator Bramnick’s statement makes clear, we need New Jersey’s Legislature to pass SCR138 and protect us all from the Labor Department’s proposed independent-contractor rule.

And then, ideally, we need our legislators to take action so this kind of threat to our state’s workforce and economy can never happen again.

Why can't NJ learn from CA that not only is it wrong to inhibit freelancing in the 21st century it hurts individual independent contractors who are more likely to be female and of color. In addition the race to get an exemption from the legislators favors professions that are wealthier and more politically savvy. Stop the madness now! Republican Senator Jon Bramnick needs to block all exemptions to put pressure on NJ to repeal this law.

This process of creating all these carve-outs is absolutely ridiculous. Not only does it favor professions that can afford a strong lobbying effort and leave everyone else hung out to dry, but it's also just incredibly inefficient government. Why are taxpayers spending so much money on lawmakers micromanaging umpteen individual exemptions? Surely there are more pressing issues. Just ditch the whole IC reclassification nonsense and move on already! It's OK to admit it was a bad idea...in fact, voters will respect you more for admitting it!