Numbers Game

Governor Murphy's 2019 task force report that kicked off the current wave of New Jersey freelance busting is riddled with questionable claims.

The New Jersey Department of Labor & Workforce, when it proposed a rule in late April to try and restrict independent contracting statewide, was crystal clear about the document that has served as the cornerstone of state actions in this policy area the past half dozen years:

“Soon after taking office, Governor Murphy created the Task Force on Misclassification, which released a comprehensive report with recommendations leading to the Governor signing a package of laws in January 2020. … In July 2021, the Governor signed another package of misclassification laws, also with bipartisan backing, which streamlined NJDOL’s ability to work with sister agencies, created the Office of Strategic Enforcement and Compliance under NJDOL and empowered the department, through the Attorney General, to bring affirmative cases against those who violate our laws and seek permanent injunctions for forward compliance with NJ labor laws.”

That “comprehensive report”—which has already been used to justify the enactment of 10 laws, creation of a new government agency office, and granting of what the Labor Department calls “first-of-its-kind” penalty power—is the Report of Gov. Murphy’s Task Force on Employee Misclassification.

I vaguely remember reading this report in late 2019, when New Jersey legislators tried to pass a freelance-busting bill similar to California’s Assembly Bill 5—a bill that would’ve put properly classified, thriving independent contractors like me out of business. Back then, I didn’t even know this task force existed, let alone that it could affect freelance writers and editors like me.

It also didn’t occur to me that I should comb through the footnotes in this report to see if what the governor’s task force claimed was even true.

Now, I know better, about state and federal reports alike.

I testified before Congress last month:

“As a matter of routine, freelance busters claim that 10% to 30% of independent contractors in the United States today are misclassified. Congress should question this claim.”

My written congressional testimony (pages 5-8) details not only how this 10% to 30% claim about today’s workforce is based on research as old as 1984, but also how a key statistic in the New Jersey report is mischaracterized, too.

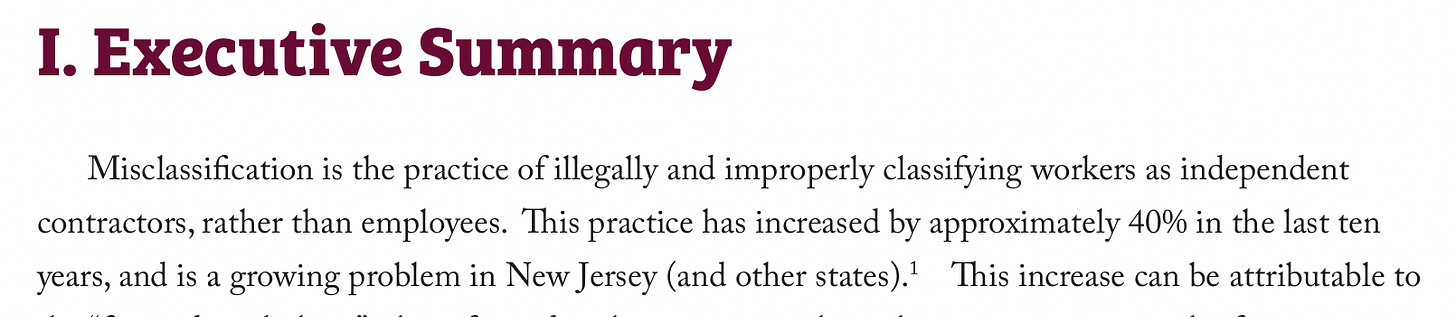

I pointed Congress to the first two sentences of Governor Murphy’s task force report—the setup for the entire narrative about misclassification being a growing problem:

I urged Congress to follow that first footnote, and to read the Harvard Business Review article it cites for the claim that misclassification increased by approximately 40% from 2009 to 2019:

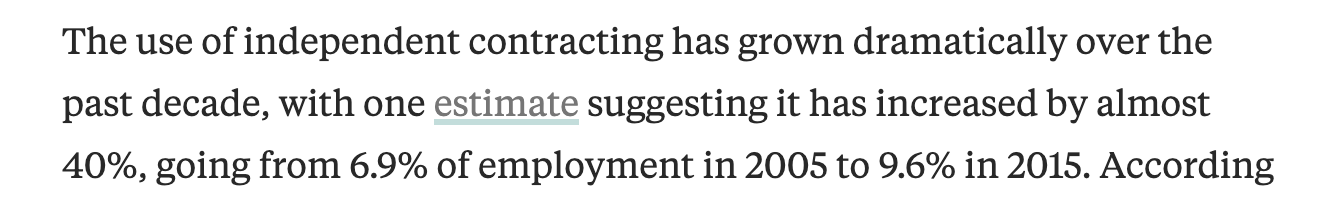

This is what that Harvard Business Review article actually states:

That doesn’t say misclassification increased by 40% from 2009 to 2019.

It says independent contracting increased by 40% from 2005 to 2015, years that included the Great Recession. A lot of people lost traditional jobs. They turned to freelancing as the iPhone was invented and laptop computers became more widely available.

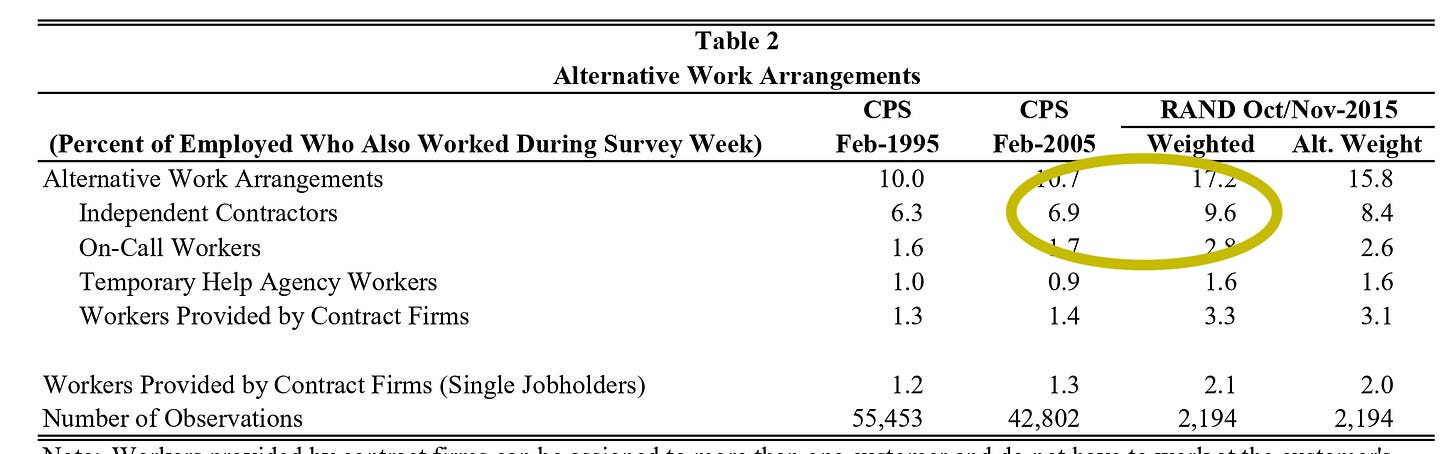

I then made sure the source material for that Harvard Business Review article said the same thing. The original hyperlink is now a dead end from Harvard Business Review, so I used the Wayback Machine, which sent me to this report by Harvard University and the National Bureau of Economic Research.

That original source material’s data also says that independent contracting grew from 6.9% in 2005 to 9.6% in 2015:

All of which made me curious to dig through Governor Murphy's entire task force report anew.

I now believe that not only Congress, but also the New Jersey Legislature, should urgently be questioning this report’s claims, and reconsidering all the laws and unprecedented regulatory powers that resulted from it.

So Many Questions

The challenge here is that the trail of breadcrumbs can be winding and long. Sometimes, you have to read through multiple mind-numbing reports and then their footnoted reports and then their sources, too, in order to get to the facts.

I found several more claims in Governor Murphy’s task force report that require serious scrutiny. Here, I’m going to show you the research underlying just one other paragraph—so you can see all the steps necessary to untie the Gordian knot of questionable information.

This is the start of paragraph three in Governor Murphy’s task force report:

To begin, Footnote 3 should have led me to “a 2000 U.S. Department of Labor study of misclassification in construction in New Jersey.”

But it doesn’t. Footnote 3 instead cites a 2016 report titled “The Underground Construction Economy in New Jersey,” by Stockton University’s William J. Hughes Center for Public Policy.

Here is that Stockton University report. Far from being a U.S. Department of Labor study, the first line of its executive summary states that: “The William J. Hughes Center for Public Policy was contracted to study the underground commercial construction economy in the state of New Jersey for the Bricklayers and Allied Craftworkers Labor Management Committee of New Jersey, the Carpenter Contractor Trust, Associated Construction Contractors of New Jersey and Masonry Contractors of New Jersey.”

This is a study written for a good number of people associated with union labor. In fact, the Stockton University report states on Page 11 that New Jersey was actually failing to work with the U.S. Department of Labor on the issue of misclassification:

Next, I dug into the claim in paragraph three of Governor Murphy’s task force report about how much tax income New Jersey is losing to misclassification. Those figures come from this Stockton University report. The footnote in Governor Murphy’s task force report references a bullet point with those figures on page 3 of the Stockton University report, but I went beyond that and read the research on pages 8 and 9 about that bullet point.

I noted a preface from the Stockton University authors (page 7) that: “there is no foolproof method of trying to measure something that by its nature is mostly invisible, and any estimates should not be taken as absolute.”

So, after acknowledging that what they’re writing is not necessarily true, the Stockton University researchers then say the $11 million figure is based in part on “anecdotal evidence” from “union officials, day laborers and an activist organization,” and “these estimates apply tax rates to all of the income, while in reality they would apply to taxable income only.” The “nearly $9 million” figure is based on an estimate that assumes misclassified construction workers earn $57,135 but report income of only $39,990; that all the misclassified workers are from two-earner families that file taxes jointly; and that the second worker’s annual earnings are approximately $20,000.

That many assumptions and estimates made me wonder about Governor Murphy’s task force claim: Does “a 2000 U.S. Department of Labor study of misclassification in construction in New Jersey” even exist at all?

Based on page 65 of the Stockton University report, this reference is to the “Planmatics study.” The Stockton authors describe it as the “comprehensive 2000 U.S. Department of Labor-commissioned Planmatics study that relied upon sophisticated audit methods to assess the prevalence of misclassification in nine states, including New Jersey.”

Comprehensive.

Sophisticated audit methods.

Groovy. I dug into that one.

The Planmatics study is, indeed, a 2000 U.S. Department of Labor-commissioned study about misclassification. It is about numerous industries as they existed in the late 1990s, and its bias is clear from the jump, on page iv, where it says there’s a need to make independent contractors more like employees.

This 196-page Planmatics study does include a two-page description of New Jersey’s construction industry, on pages 43 and 44. It cites three sources on those two pages.

The first source of this Planmatics research is an unnamed dude from the AFL-CIO:

The second Planmatics source is also unnamed, but is identified as executive director of the Building Contractors Association of New Jersey. His contribution to the research is this sentence: “Anyone skirting the system and not paying what they are supposed to pay has an unfair advantage over the legitimate guy.”

As for the third and final source of this research about the New Jersey construction industry, the Planmatics study goes into detail about a case involving a Texas company called Houston Dry Wall. It says Houston Dry Wall “transported legal and illegal immigrants from Texas to New Jersey to work in residential construction sites, as independent contractors.”

The Planmatics study’s footnote for this Houston Dry Wall case is a February 18, 1999, article titled “Builder caught in state tax crackdown” from The Star-Ledger newspaper.

I used my library card to access that article. It’s 679 words long, about one-third the length of this Substack post. The story didn’t seem to be big news in 1999. It ran on page 35 in the Star-Ledger’s business section.

It begins like this:

“First came the tip. Then the tax auditors went to work. A 20-question litmus test of what makes an ‘independent contractor’ an ‘employee’ was put to use.

“Now, a Texas dry-wall company stands accused of the ‘illegal avoidance’ of nearly $600,000 in state income and wage taxes by classifying some 600 workers as independents and paying them in cash.

“It became the first of a dozen companies to catch the attention of state officials since the launch last year of a widespread joint investigation by the Department of Labor and Division of Taxation into the inner workings of the construction industry.”

So, to recap: The sources for what Governor Murphy’s task force report describes as “a 2000 U.S. Department of Labor study of misclassification in construction in New Jersey” are estimates that authors from Stockton University commissioned by union-related organizations say we should not take as absolute; an unnamed dude from the AFL-CIO; a trade association guy who says some businesses cheat the system; and a newspaper article about a Texas-based company and a dozen other unnamed companies.

You can decide for yourself whether the word “comprehensive”—as the New Jersey Department of Labor calls Governor Murphy’s 2019 task force report—is being appropriately applied.

Did You Miss the Best Part?

Now, I want to make clear, for the umpteenth time, that companies cheating their employees should be held accountable. I was born in New Jersey. I’ve lived here a long time. Based on what I see, plenty of construction companies have workers who aren’t from the United States. I have no doubt that if you poke a stick into that industry, you’ll find people who should be classified as employees, but who take cash under the table because they aren’t here legally, and they don’t understand a word of English.

But I can read English—and it’s important to read what source material actually says, because according to the first paragraph of The Star-Ledger article, New Jersey regulators were able to find and address that particular problem in the construction industry when tax auditors used a “20-question litmus test of what makes an ‘independent contractor’ an ‘employee.’”

That is the 20-question IRS Test.

And that matters a lot in terms of what the New Jersey Department of Labor is trying to do to all of the state’s independent contractors, including me, right now.

The IRS Test is the regulatory language that legitimate independent contractors like me have been saying all along is a reasonable way to determine worker status. It can stop employee misclassification without harming the vast majority of us who are properly classified and overwhelmingly prefer to be self-employed.

The IRS Test is massively different from the wholly unreasonable ABC Test that the freelance-busting brigade keeps trying to inflict on us nationwide. California imposed the ABC Test in 2019-20 with disastrous results. (Or “catastrophic,” as the Deputy U.S. Labor Secretary described it in an op-ed this week.) The ABC Test generated so much public outcry in New Jersey’s 2019-20 legislation that the bill failed. New Jersey’s Department of Labor is now trying to weaponize this ABC Test in ways that a top attorney wrote will “lead to the elimination of all ICs in New Jersey.”

This ABC Test is a proven job-killer. So much so that members of the California Advisory Committee to the U.S. Commission on Civil Rights issued a report describing it as a “seismic change” in policy with a “decidedly negative impact.”

So much so that a California assemblyman is calling on the U.S. Department of Justice to investigate.

So much so that legislation has been introduced in Congress—legislation I testified in support of last month on Capitol Hill—to try and prevent this kind of freelance busting from spreading anywhere else.

Those Are Just Two Examples

I could go on—and I will go on in the future—about the deeply problematic 2019 Report of Governor Murphy’s Task Force on Misclassification. The examples I laid out above are from just two paragraphs on page one of the 30-page document.

For now, I think these two examples clearly demonstrate the way this report was written—and how lawmakers of good conscience, even if they trusted this report and voted to support freelance busting in the past, can help to fix the crystal-clear policy problem now.

I look forward to speaking with them, and to testifying at the June 23 public hearing on New Jersey’s proposed independent-contractor rule.